Buckit - Pay Off Debt, Smartly app for iPhone and iPad

Developer: Buckit Inc

First release : 18 Apr 2017

App size: 43.49 Mb

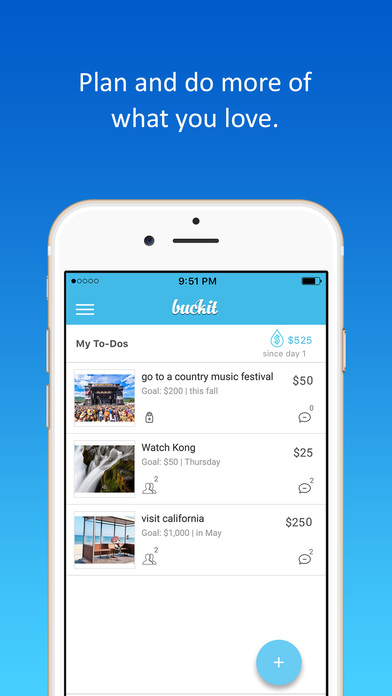

Buckit is a robo credit card manager that helps you pay off debt and improve credit. With Buckit, credit card payoff can now be put on auto-pilot: it analyzes your debt and finance data and applies smart strategies that help you payoff debt faster and reduce interest costs. Buckit automatically sets aside money to your Buckit account to save for debt payoff so you don’t have to worry about it. You can add, withdraw money or adjust the savings pace at any time. Buckit offers one of the best credit card payoff solutions in the market today.

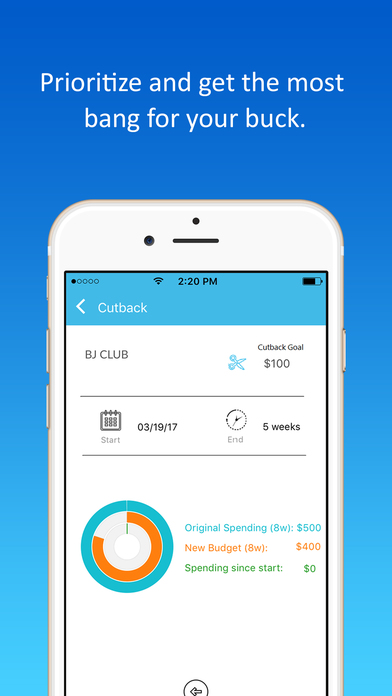

- Easy to use. Simply link your accounts and let Buckit do the analysis. You can see the simulated results of your projected debt payoff with debt calcalator: debt snowball, avalanche - you can choose a plan that fits you the best and Buckit will help you execute it.

- Automatic. Fine-tuning the plan, setting money aside regularly and making payments when the bill is due; Buckit does it all for you.

- Intelligent. Buckit learns about you and your finances to help optimize debt pay off: pick the right card to pay down first, balance between spending and saving, and look for opportunities to refinance with a better credit product.

- Rewarding. A few extra dollars saved every week can snowball into big savings - up to 20-40% in total interest costs over the life of a loan.

How it works

Link your credit card accounts and a bank account to fund payments, and choose a plan - that’s it! Buckit sets money aside weekly from your bank account and uses the savings to pay off credit card. Buckit is intelligent about how it saves and pays; for instance, it auto-adjusts your saving pace when your bank account balance is low, and it pays down the card with the highest interest rate first.

It is secure

Buckit uses 256-bit encryption on all your information - the same encryption level that banks use - and adopts a comprehensive multi-layered approach to security to ensure your account remains protected.

Get on the journey to better credit with Buckit.